Watch any news program these days, and there is still a lot of talk about inflation and interest rates. Half the experts seem convinced inflation has been extinguished and the other half seems to doubt it is really gone.

The Slope of Inflation

I’m not sure anyone really knows the answer, including the Federal Reserve, but if inflation isn’t totally gone, the implications for contractors bidding fixed priced contracts is huge. That being the case, it’s worth considering the possibility that inflation reemerges and what that could look like. To do that, let’s take a trip back to the 1970’s and 1980’s.

In the mid-1960’s inflation was at 1% and began to gradually rise over the next decade due to excessive spending by the federal government to support the Vietnam War and new social programs that were being enacted. This combined with the oil embargo in 1973 pushed inflation up to 11% by 1979, the year Paul Volcker became chairman of the Federal Reserve Board.

Economists and policy makers [can become] a little bit too confident about their ability to keep the economy on an even keel.

Ben Bernanke, Former Federal Reserve Chair

Volcker set out to squash inflation by using the Federal Reserve’s tools to control the money supply. As a result of these actions, interest rates spiked to just over 17%, lending activity fell, unemployment rose, and the country entered into a recession between January and July of 1980.

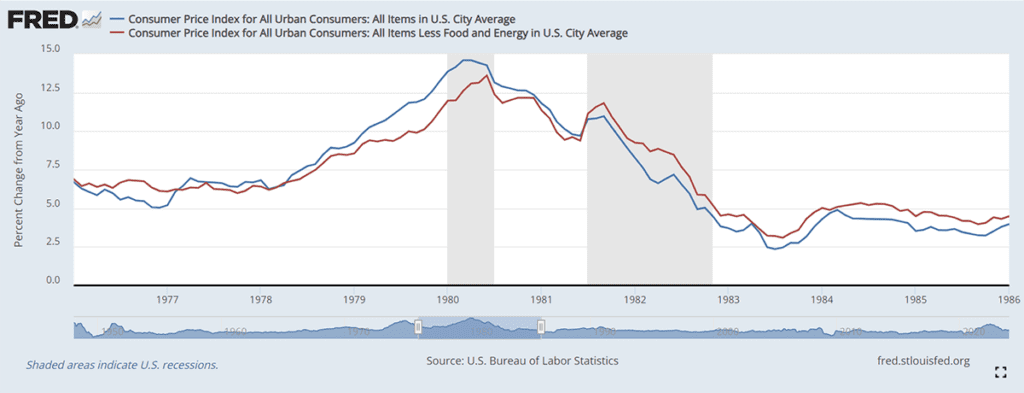

Inflation came down in the second half of 1980 as the economy recovered from the recession, and interest rates dropped down to around 10%. However, as you can see in the chart below, inflation was still higher than normal, and began to rise again at the beginning of 1981, so the Federal Reserve had to increase interest rates for a second time peaking at 19% causing a second recession by that July.

Conclusion

While there has been much talk about the current Federal Reserve engineering a “Soft Landing” of the economy, it is not always as easy as it sounds. As former Federal Reserve Chair Ben Bernake once remarked, “economists and policy makers [can become] a little bit too confident about their ability to keep the economy on an even keel.”

There are many inputs and outputs in our economy, and while the Federal Reserve has many tools, it is not as easy as flipping switches on a control panel.

Just as the economists and policymakers need to be humble in their abilities, we need to be humble in what we think we know will happen. That means preparing for various outcomes, and one of those outcomes could be that inflation resurges. In case it does, contractors need to proactively protect themselves accordingly by locking in prices, adding contingency to their bids, and potentially being wary of projects that don’t start for many months or could possibly get delayed.

As the 1980’s shows, things don’t always happen in a straight line, and the first line of defense for being prepared for a potential problem is being aware that it could exist.

Get a payment bond quote now

We want to know more about how we can help your construction company get the right contractor bond for your next project.