Employee Stock Ownership Plans (ESOP) are becoming an increasingly popular way for owners of construction companies to exit their business. According to data from The National Center for Employee Ownership, there are 160 ESOP construction companies in California, and almost a quarter of those were formed in the last 5 years. This article will provide a basic introduction to ESOP’s for construction companies with subsequent articles providing greater detail on various aspects of ESOP’s.

What is an ESOP?

An ESOP is a qualified retirement plan governed by the Employee Retirement Income Security Act (ERISA), which is the same laws that govern other retirement plans like 401(k)’s. With an ESOP, employees are eligible to receive shares in the construction company over time based on the company’s overall profitability. Because ESOP’s are qualified retirement plans, there are strict compliance requirements, and that means companies not only need to have internal staff well versed with the regulations but a team of outside service providers that are experts.

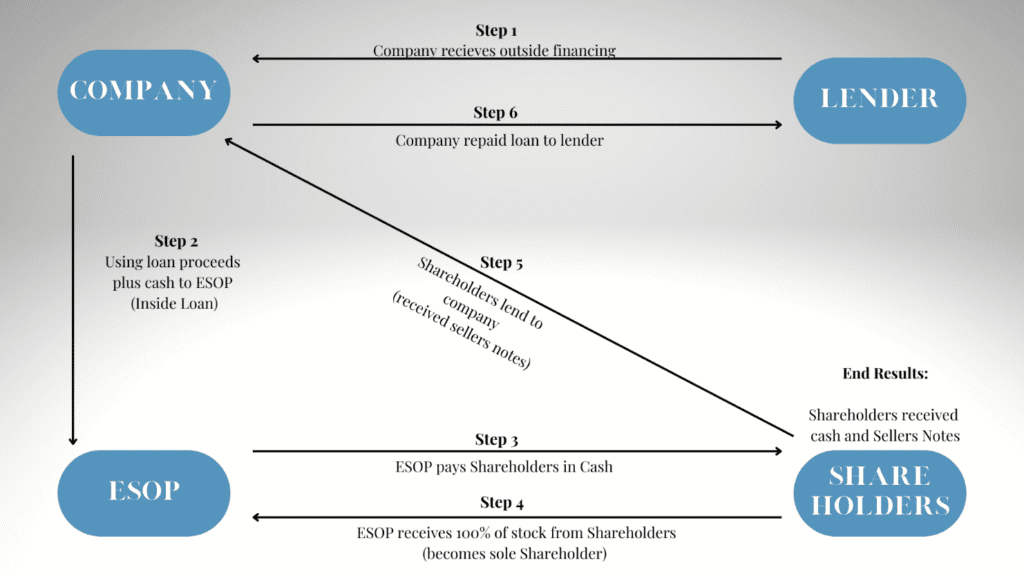

What does an ESOP Transaction Look Like?

This is where most people start to get lost, because there are a lot of moving parts. The first step is setting up an ESOP trust, which will hold the shares on behalf of the employees. Next, the company contributes money to the trust, and/or the trust borrows the money from the bank and/or the seller of the company, and the trust uses that to purchase all or part of the shares from the seller. The trust then allocates the shares to the employees over time as the debt is repaid.

Is all or part of the company being sold?

To form an ESOP, any amount of the company stock can be sold, and it does not have to be 100%. In fact, many owners of construction companies intentionally sell only a portion of the company stock in order to manage the amount of debt the company takes on, which can also be favorable from a surety company’s perspective. There are tax implications to this approach which should be discussed with a CPA.

Debt with ESOP Transactions

Almost all ESOP transactions are funded with debt. Sometimes the debt to purchase the stock will come entirely from the selling shareholder(s) and other times a bank may finance a portion of the sale with the selling shareholder(s) taking back promissory notes for the balance. Typically, banks won’t finance more than 30% of the purchase price, and their loan will have a term of 5 years. The bank’s loan takes priority over the seller notes, which means the seller can’t usually collect principal payments (only interest) until the bank loan is paid off.

ESOP Service Providers

All of the complexity involved in setting up an ESOP requires many expert service advisors. Those advisors include:

Appraiser – They will provide an initial valuation of the company.

Administrator – They keep all the records, make sure forms are filed with the government, and handle getting information to plan participants.

ESOP Trustee – Their job is to represent the interests of the shareholders. They will do things like review the initial appraisal, negotiate with the seller to come up with the final price for the company, and review compensation of key executives of the company.

Bank – Provides a loan to the ESOP trust to purchase the shares from the seller. Only certain banks are well versed in ESOP’s and provide loans for these transactions.

Legal – Attorneys are needed to draft all of the various agreements.

CPA – Help you work through the entity structure (S Corp or C Corp) considerations and various tax implications from the sale both for the owner and the company.

Ownership culture consultants – Many companies choose to hire these consultants to help their employees understand the benefits of the ESOP and to create the ownership mindset.

Deciding if an ESOP is Right for Your Construction Company

ESOP’s are not for every construction company, and in our next article we will go over some of the key considerations to determine whether an ESOP may be the right fit and worth exploring.

Get a Surety Bond quote now

We want to know more about how we can help your construction company get the right contractor bond for your next project. Fill out the form and one of our local expert bonding agents will be in touch with you shortly.

"*" indicates required fields

Get a bid bond quote now

We want to know more about how we can help your construction company get the right contractor bond for your next project.